The buzzword that’s on the edge of every astute transformation manager’s lips is ESG – all those in the know are designing ESG strategies, but how many are actually reporting on these? IRAS’s Sustainability Data Transparency Index (SDTI), which was released in 2021 after a four-year hiatus, reveals how JSE-listed companies have progressed since the last report (2016). We delve into the SDTI findings in this blog, unpacking what ESG is, why ESG reporting is so critical, and how YES can help your business reach its ESG goals.

To ESG or not to ESG? That shouldn’t be a question

Much like the South African question, to B-BBEE or not to B-BBEE? (for which YES says yes, B-BBEE! Read more here and here), it is becoming increasingly apparent that more companies and communities are saying YES to ESG.

ESG (environmental, sustainable and governance) strategies have become more and more important for investors and customers alike. The advent of ESG investment indices such as FTSE Russell, RobecoSAM, MSCI and others, has shown that those buying both stocks and/or products care about a business’ external environmental and socio-economic impact, as well as internal governance structures that affect people, planet and processes.

It’s one thing to conceptualise a fantastic ESG strategy, but it’s another thing entirely to report on it transparently. That’s where the Integrated Reporting and Assurance Services' (IRAS) SDTI comes in. The small, Johannesburg-based assurance consultancy has analysed 266 JSE-listed companies’ annual report suites against 187 global and national indicators (102 of these indicators are scored, to provide a final score for each company, as well as averages across industries and the entire sample size).

Why is it so important to know whether a company is actually reporting on their ESG efforts? It’s about transparency. The SDTI is not so much interested in how well a business is doing their ESG (that’s more of a qualitative and, in some instances, biased analysis), but whether they’re reporting on it (completely unbiased and quantitative – did they report their carbon emissions? Yes – 1 point. Was it easy to find? Yes – another point).

To fully comprehend why ESG reporting is so important, let’s ask ourselves what the absence of reporting indicates to shareholders and customers.

While the index does not have the same hype around it as would a World Bank or IMF report, it does provide useful insight into the state of ESG reporting in South Africa. There are some subjective and strongly worded opinions in the report, which is why we’ve specifically highlighted objective and pertinent pages that are specifically related to business.

How does the SDTI work?

Companies analysed

As mentioned above, the SDTI analysed 266 JSE-listed companies against 187 indicators, 102 of which are scored. Some companies were removed from the population based on a lack of information, delisting, being a new listing with no annual report as yet, or based on “not being South African enough” – i.e. being listed on JSE but not having significant operations in South Africa.

Indicators

|

Category |

# of Indicators |

Description |

|

Standard Disclosures |

19 |

Indicators refer to whether or not a report has been assured, includes a King IV checklist, and is aligned to the Global Compact, and thus the Sustainable Development Goals (SDGs). |

|

Economic |

46 |

Indicators refer to revenues and profit generated, as well as compensation paid to directors and employees, etc. |

|

Governance |

29 |

Indicators refer to the composition of the board, inclusive of lengths of service and gender and racial representation, etc. |

|

Labour |

23 |

Indicators refer to the number of employees, employee turnover and absenteeism, training spend, etc. |

|

Health and Safety |

16 |

Including hours worked, number and frequency of fatalities and lost time injuries, etc. |

|

Environmental |

36 |

Including consumption of water, electricity and/or other energy, and waste and emissions data, etc. |

|

CSI/SED |

18 |

Including total rand value of corporate social Investment (CSI) / socio-economic development (SED) spend, and a break-down in terms of focus areas, etc. |

|

Total |

187 |

Scoring – How it works

|

Score |

Points |

Description |

|

OK |

2 |

The highest one can score, this represents whether quantitative data (numbers, spend, etc.) was reported and could be easily found, or did not require any manipulation or calculations, and was not obviously incorrect. |

|

OI |

1 |

Stands for “opportunity for improvement”. A company receives this score if the data is deemed as partial. Partial means that one had to calculate, estimate, and/or source from alternative documents not in the report, or where data was clearly incorrect. |

|

NC |

0 |

Stands for “not covered”. This is where the information or data could not be found. |

Scoring – What’s considered good, bad, and ugly

|

Score |

Rating |

|

70.0% + |

Excellence in ESG reporting |

|

60.0% - 69.9% |

Good |

|

50.0% - 59.9% |

Fair |

|

40.0% - 49.9% |

Reasonable |

|

>40.0% |

Although the report doesn’t mention what these scores are regarded as, it is fair to assume that these would be considered a “fail”. |

Overall performance

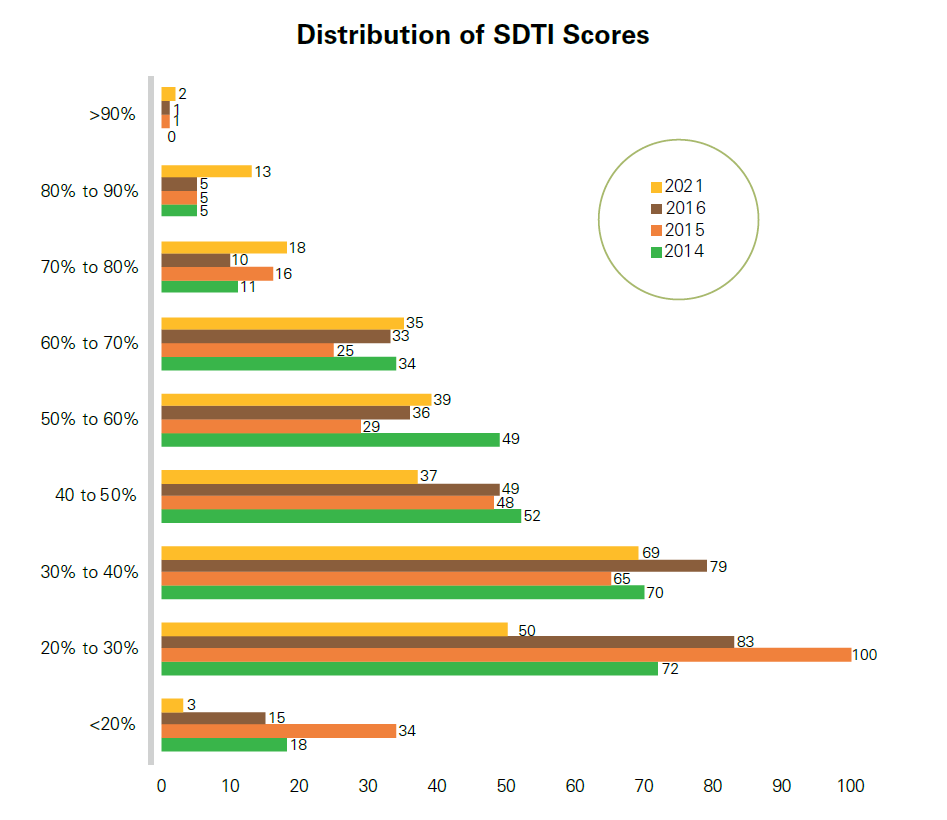

This analysis covers the average performance per category. Overall, the average total score among the 266 companies was 46.78% (‘Reasonable’). While this does seem low, what is interesting is how far this average has jumped since 2016 – it moved up 16.08% from the 2016 score of 40.30%. This jump indicates the upward trajectory of ESG reporting. The table below shows how many companies received each score.

Companies per rating

|

Score |

Rating |

# of companies |

Movement |

|

70.0% + |

Excellence in ESG reporting |

12.4%, or 33 out of 266 companies, scored above 70% |

Up by 5.1% from 2016 |

|

60.0% - 69.9% |

Good |

13.2%, or 35 out 266 companies, received a rating of ‘Good’ |

Up by 10.6% from 2016 |

|

50.0% - 59.9% |

Fair |

14.7%, or 39 out of 266 companies, received a rating of ‘Fair’ |

Up by 11.6% from 2016 |

|

40.0% - 49.9% |

Reasonable |

13.9%, or 37 out 266 companies, received a rating of ‘Reasonable’ |

Up by 15.8% from 2016 |

|

>40.0% |

Fail |

45.9%, or 122 companies, scored below |

From the scoring table above, more companies are being rated and scored above 40% than those that are ‘failing’, illustrating how more and more companies are buying into the value of ESG reporting. The graph below, which shows the distribution of SDTI scores in each category and compares years, also shows how the companies that are scoring below 40% are steadily decreasing.

While the average score across 266 companies was 46.78%, the median score was 43.14% (up from 36.26% in 2016), which means that any company scoring above this median falls into the top half of (or top 133) companies.

Source: IRAS SDTI report, 2021, p. 25

Average scores by category

The below table outlines the average scores per category. As noted in the report, the higher averages for the economic and governance categories is impressive, and likely due to the impetus placed on financial reporting, as well as the King IV.

However, the other categories show dismal scores, particularly Health and Safety, which was down 1.1% from 2016. South Africa is noticeably behind in their environmental reporting, scoring an average of 27.7%. This at a time where international pressure to be transparent about environmental impact, and reduce said impact, has never been more intense. The under-reporting of CSI/SED spend is also confusing, especially in South Africa, where socio-economic development in the B-BBEE space is crucial to staying competitive and creating a more transformed society.

Not reporting leaves room for stakeholders to make assumptions – fair or not. This under-reporting is a massive missed opportunity for South African businesses, and could at some stage result in loss of investment and/or clients.

|

Category |

Average Score |

Movement |

|

Economic |

74.7% |

Up 9.4% from 2016 |

|

Governance |

80.2% |

Up 15.3% from 2016 |

|

Labour |

41.3% |

Up 3.7% from 2016 |

|

Health and Safety |

18.8% |

Down 1.1% from 2016 |

|

Environmental |

27.7% |

Up 6.6% from 2016 |

|

CSI/SED |

27.3% |

Up 0.4% from 2016 |

Trends in ESG reporting – why it’s becoming more crucial for your business

The report noted that ESG reporting is becoming more and more reliant on data – meaning that the goal is to ensure that an entity provides stakeholders with numbers that can “either prove or disprove an assertion”. Basically, ESG reporting should be treated the same as financial reporting. Other trends that were observed in the report were:

- Reporting around UN Sustainable Development Goals (SDGs) is no longer just focused on including the goals that are relevant to the company strategy, but rather is beginning to explain SDG links to materiality, relevant SDG-specific targets, company progress in reaching these targets, and company-specific targets.

- Increasing frequency of ESG information requests by key clients and stakeholders, and use of this information in supply chain decision-making.

- Long-term investors are also actively engaging on ESG information, particularly SDGs, and how the company is/isn't planning to impact these.

- Non-executive directors are becoming more acquainted with ESG matters in terms of risk, particularly human rights, living conditions, environmental (non)compliances, etc.

- Benchmarking exercises and studies are beginning to take place on the part of the stakeholder

How can I ensure that my business is reporting on ESG adequately?

We have compiled a list of important pages from the SDTI report so that you can benchmark the information your company has and is reporting, against what it doesn’t have and is not reporting on.

|

Important pages for analysis |

||

|

Title |

Description |

Page |

|

Response rates to scored SDTI indicators |

Lists all indicators and categories against which company reporting is measured, and includes which indicators are scored. |

84 |

|

2021 SDTI research population |

Compares this year’s scores for each company versus their 2016 scores. |

90 |

|

2021 SDTI summary performance tables (by sector) |

The crux of the entire report, this shows averages for each company across ESG categories, and a final score for each. |

96 |

|

Kumba Iron Ore – SDTI gap analysis |

As Kumba Iron Ore received the best scores for the reporting period, IRAS published the score for each indicator . |

110 |

YES can help you with your ESG/SDG strategies

Integrating with YES for improved impact, It’s about more than jobs: The turnkey solution

The YES turnkey solution works with 33 YES-vetted host partner across South Africa to place youth. If a corporate cannot place youth in their own organisation, they have the option to place youth with our host partner. The YES host partners are generally NGOs working in high-impact sectors communities, which means youth do not have to travel far for work and they can play an important part in building their own communities.

Some sectors YES host partner work in

Essentially, your company can use the creation of youth jobs to also impact social, environmental and economic issues that align with your holistic ESG/SDG strategies - meaning your business can create critical youth jobs in sectors that are relevant to you, effectively ‘killing two birds with one stone.’

The turnkey solution is a true one-stop solution for organisations looking to make all of the impact with none of the admin. Host partner are not only responsible for hosting youth, but also for recruiting, screening, and supervising the youth, as well as facilitating absorption on behalf of the corporate.

Creating youth jobs in sectors that build economic, social and environmental stability in communities (through the turnkey solution) is an effective way to systemically and holistically reach your ESG goals, and create a report that you can be proud of.

Join the movement, calculate your target here and co-create a future that works for all.

Source:

Integrated Reporting and Assurance Services (IRAS), 2021. Sustainability Data Transparency Index (SDTI).

%20(1)-3.png)

.png)